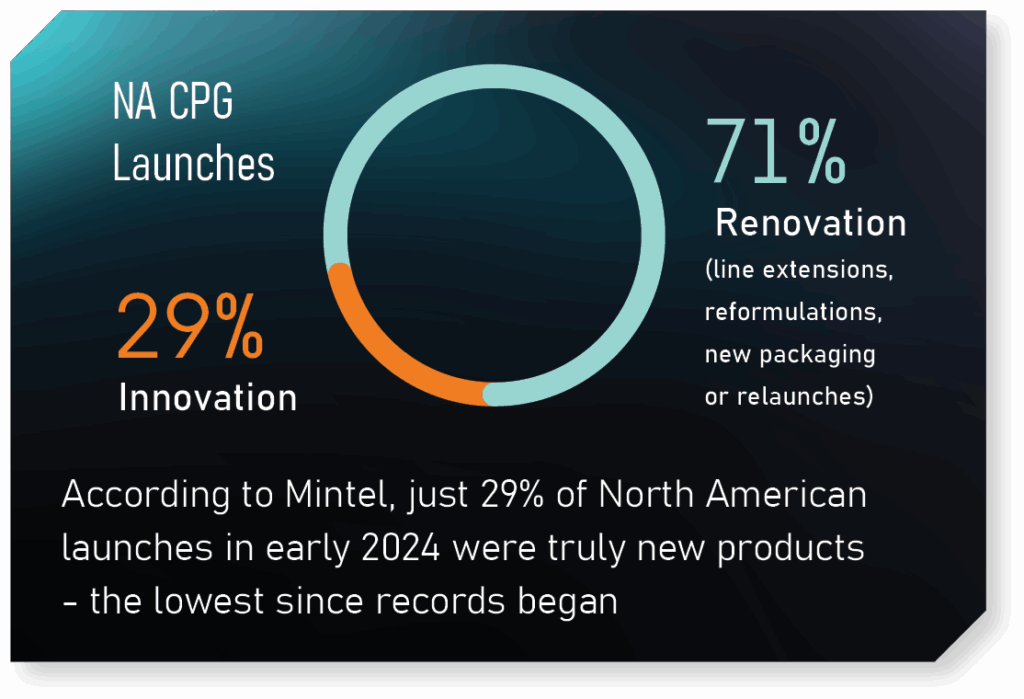

It’s a hard truth: innovation, the engine of growth for decades, is stalling. Across industries, and particularly in Consumer Packaged Goods (CPG), the pace, ambition, and success of innovation have slowed significantly. According to Mintel, just 35% of global CPG launches in early 2024 were truly new products – the lowest since records began. In North America, that figure falls to just 29%.1

CPG has an innovation shortage

This isn’t just a blip. It’s a full-blown crisis.

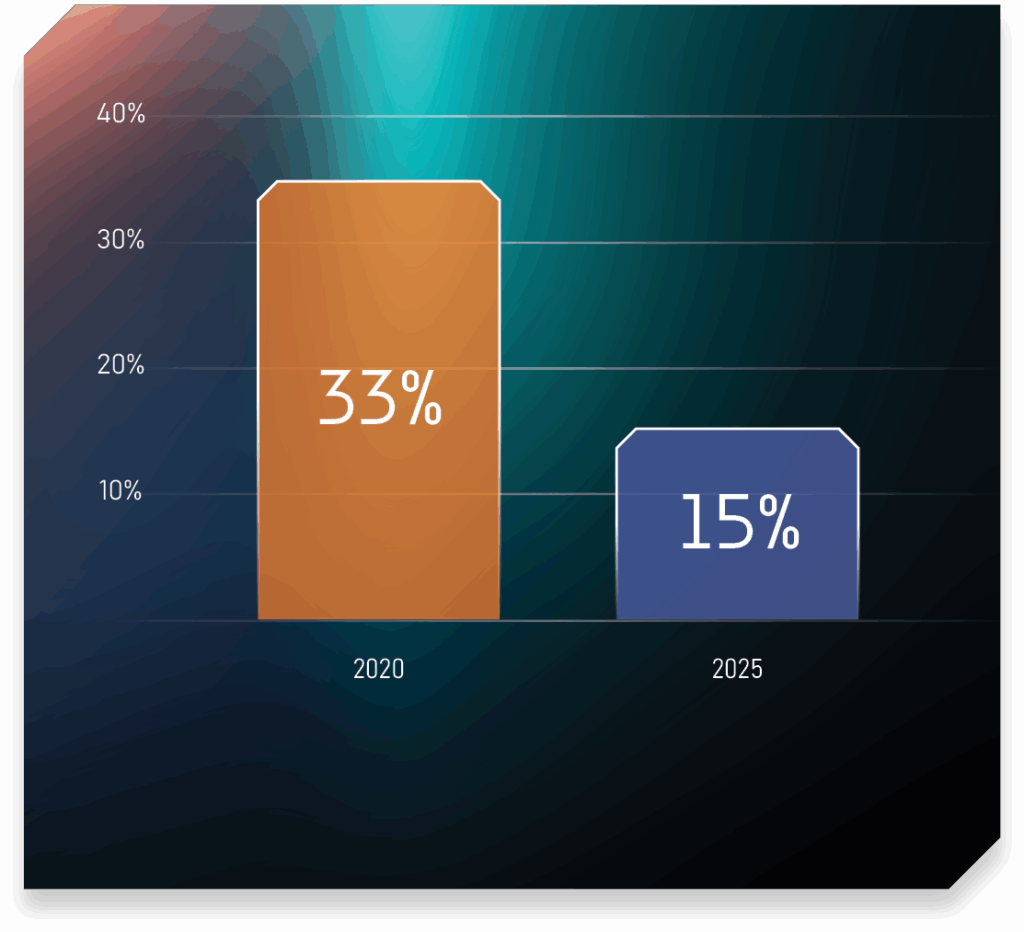

The market is flooded with indistinguishable offerings in what’s been dubbed the “age of average.” Consumers are turning to private labels, not just for affordability but because 72% now perceive them as equal in quality to branded alternatives, according to the EY Future Consumer Index.2 Half as many ideas stand out to consumers compared to five years ago – according to the Ipsos database, the world’s largest, only 15% of ideas tested were seen as highly differentiated, down from 33%.3

The consequences are visible both on the shelf for consumers and on the balance sheet for investors. Brands once known for bold thinking now rely heavily on promotions and pricing tactics to stay afloat.

The economic environment isn’t making things easier. Inflation, tariffs, and rising production costs are forcing companies to slash R&D budgets and squeeze their innovation pipelines. Pressure on pricing from a demanding trading climate, exacerbated by commoditization of many categories and by rising costs, is squeezing investment in insights and innovation capabilities. According to WIPO, global R&D investment in CPG has dropped from 5% to 2.9% in just one year, and, for the first time since 2009, international patent filings are down.4

Bold, meaningful innovation is no longer a nice-to-have; it’s the clearest path out of this sameness trap and towards long-term growth.

The risk of putting the brakes on innovation

When companies pull back on innovation, top line revenue doesn’t just slow – it stalls. Without a steady pipeline of new, differentiated offerings, the top line flatlines. In response, many organizations make the short-sighted move to further reduce their investment in innovation, hoping to protect margins. But this only accelerates the decline. They fall into a downward spiral, weakening the very capabilities needed to fuel future growth.

Yet this is precisely when innovation matters most. It’s not just a response to opportunity; it’s a defense against decline.

A useful test for any leadership team is this: can you clearly quantify the contribution that innovation made to your top line growth last year? What about this year, or next? If the answer is vague or unavailable, it’s a sign that innovation is being treated as a tactic, not a strategic growth engine.

McKinsey analysis shows that only 25% of growth in the CPG sector from 2016 to 2020 came from leading brands.5 The rest? Captured by small, nimble players and private labels. The playing field isn’t just changing… It’s leveling. Legacy brands that fail to innovate are losing relevance, market share, and momentum.

Why the paralysis?

- Lack of strategic planning. Many companies simply can’t articulate the contribution of innovation to their current growth, let alone its role in their future plans. Ambition for innovation and availability of resources are often misaligned.

- Innovation is not a priority. Only 12.4% of CMOs cite innovation as their top priority in 2025, despite 83% claiming it’s among their top three. And just 12% of companies report a strong link between innovation and their corporate strategy, despite that link correlating with 74% higher new product sales, according to a Boston Consulting Group report.6

- Empty innovation funnels. With too few ideas to work with, nearly every idea gets pushed forward from infancy to market launch… turning the funnel into a tunnel. Lacking a robust pipeline, brands lose the ability to filter out the weak ideas and concentrate limited resources on the winners. The result? More failed launches and fewer big wins. “Almost 30,000 new products are launched each year, with about 95% of them failing” claimed Harvard Business School professor, Clayton Christensen.7

- Limited consumer understanding. Consumer research is underfunded, misapplied, or altogether absent, despite consumer-centricity being heralded by many. Some companies are rich in data and research but lack the ability to extract clear insights. Even when research uncovers valuable insights, they often remain siloed, leaving brand teams and senior leaders unaware of the findings. Without clear visibility into the impact of research, executives struggle to justify continued investment. And when that investment is cut, the chances of generating relevant and differentiated innovation shrink even further.

The cost of failed innovation

Many companies underestimate the true cost of failed innovation. But to manage it effectively, organizations must first recognize its full scope. These costs often include:

- Direct costs of developing and launching the innovation: R&D, technology development, capital expenditure, marketing and advertising costs, working capital – all of which are sunk once the innovation fails.

- The opportunity cost: The lost potential of better ideas not pursued, because resources were tied up in a weaker bet. Failure to deliver a relevant solution leaves whitespace in the market, opening the door for others to step in.

- Brand equity risk: Poorly executed innovations can dilute or damage the master brand with consumers, especially if they create confusion or disappointment.

- Retailer confidence: Failed launches can erode trust with retail partners, who have little tolerance for companies who fail to deliver and waste valuable shelf space, making it harder to gain shelf space or retailer support in the future. A3

- Team morale and organizational confidence: Typically felt but not overtly recognized, innovation failures can dampen internal morale, deter risk taking, and reduce an organization’s appetite for investment in future innovation.

12 Questions to check your innovation health:

How do you know if your organization needs to revisit its approach to innovation? Here’s a checklist of symptoms that can indicate a health check is in order:

- Do teams have access and awareness of existing consumer and market research?

- Are you uncovering deeper insights than your competitors?

- Are you connecting insights across studies to spark innovation ideas?

- Are ideas tested with consumers before resources are committed?

- Are in-progress ideas based on unmet consumer needs?

- Do weak ideas get killed early, or does everything move to launch?

- How many ideas in your pipeline are true winners – and how do you know?

- Do top ideas get more funding – in development, for launch, and in-market?

- Is revenue clearly forecasted for each innovation, including cannibalization risk?

- Do in-market innovation executions deliver on the original promise of the idea?

- Is there an effective process for managing the innovation funnel?

- Are you planning for competitive response and product lifecycles?

And that’s not all

This article is the first of a broader content series brought to you by Ipsos, Market Logic, and Alchemy-Rx to confront these issues head-on. We’ll be exploring the strategies, tools, and processes that can help businesses reverse innovation paralysis in successive webinars, articles, and videos in this series.

We’re jointly commissioning new market research to bring light to the true state of innovation in CPG. These results will be shared in a comprehensive report as an exciting crescendo of our series.

We aim to help leaders reinvigorate innovation in their organizations by highlighting common challenges that CPG companies are facing and providing practical advice – for executives by executives.

If you’re responsible for driving growth, now is the time to act.

Access expert perspectives on this topic in our webinar Innovation Reignited: Why CEOs can’t afford to stand still, with Gonzalve Bich, CEO of BIC.

Sources

- Mintel. Global New Product Database. 2024.

- EY. Future Consumer Index. 2025.Ipsos. Early-Stage CPG Research in US. 2021–2025.

- World Intellectual Property Organization (WIPO). Global Innovation Index. 2024.

- McKinsey & Company. Analysis of Nielsen CPG growth. 2016–2020.

- Boston Consulting Group. Most Innovative Companies Report. 2024.

- Christensen, Clayton. Statement on new product failure rates. Harvard Business School.