Survey data suggests that European managers use more sources of market insights more often for consumer-driven decision-making; however, other factors are more important drivers of insights use.

Market insights are critical for decision-making

Market Logic Software and Insight Platforms recently conducted a large-scale survey of business users of market insights and consumer data.

With 200 participants from large and enterprise companies on both sides of the Atlantic, we had a robust enough sample to analyze any differences in the usage of consumer insights between North American and European marketing and product teams.

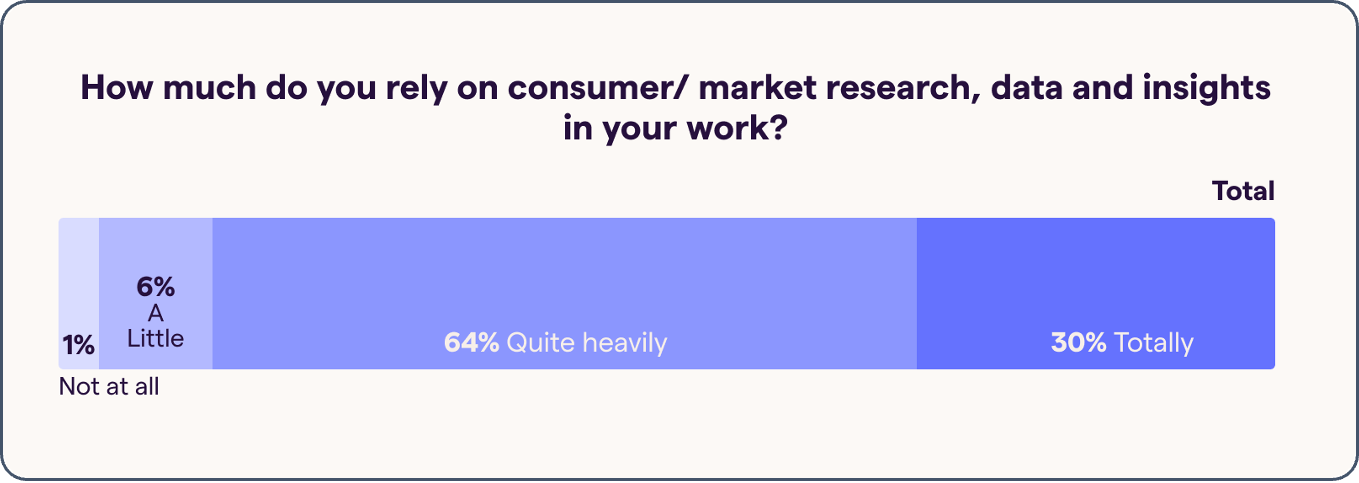

This survey revealed that these teams are highly dependent on market insights and consumer data for effective decision making. Nearly 30% of all survey respondents describe themselves as totally reliant on consumer insights for their work:

In addition, nearly 60% of marketing and product decisions taken are currently informed by consumer insights – with the potential for this to increase to 80% in an ideal world.

North American and European Teams use market insights differently

At a surface level, North American and European teams appear very similar in their approach to capitalizing on their organization’s insights with both stating that at least 60% decisions are informed by this knowledge.

However, digging deeper, there are some revealing variations:

First, European teams claim to be more reliant on consumer insights and data. Whereas just one quarter of North American marketing and product leaders say they are totally reliant on insights, this rises to one third of European business teams:

Next, European teams engage with consumer/market insights more often than their North American counterparts.

This applies across the board, from engaging with specialist insights colleagues to self-serving with AI Assistants, dashboards or Knowledge Management solutions.

Finally, European teams use all types of market insights and consumer data more often than their North American counterparts; in most cases to a degree that is statistically significant.

Why might these differences exist?

The survey also asked participants the following open-ended question:

What are the most important decisions you take that are informed by consumer research, data and insights?

Both European and North American teams emphasize the importance of market insights for strategy development, targeting & personalization, and campaign planning.

North American teams place slightly more emphasis on using insights for competitor analysis, whereas European teams place slightly more emphasis on product development and brand positioning.

Organization size and team focus are more significant drivers of market insights use

When analyzing open-ended responses, clear differences emerge based on organization size.

We divided organizations into two groups: large companies (1,000–10,000 employees) and enterprise organizations (over 10,000 employees).

Large companies emphasize targeting and campaign planning more heavily, suggesting a focus on reaching specific audiences efficiently.

In contrast, enterprise organizations place greater weight on strategic planning and brand positioning, perhaps reflecting the complexity of operating at scale and maintaining a strong market presence.

When analyzing the responses from marketing and product/innovation teams, the distinctions became even more clear.

Amongst marketing teams, campaign planning, brand strategy, and consumer journey analysis are key priorities, reflecting an operational focus on delivering market-facing initiatives.

Product/innovation teams tend to prioritize product development, market sizing, and validating hypotheses, emphasizing their role in driving future growth through data-backed innovation.

Meeting divergent needs for market insights

From the subtle differences between geographic regions to the more pronounced and meaningful differences across organizational size and departments, it’s clear that the use cases and applications of market insights vary significantly.

Our research highlighted the critical importance of systems that consolidate insights from different sources and integrate with the workflows of these differing target groups.

Competitive and Market Intelligence departments and other enabling teams should build their information strategies and technology platforms with these varied needs front of mind.

For more information and ideas to support this, read our recently published report, created with Insight Platforms, on hyperscaling insights for the full survey results — and learn how your organization can power up more decisions with insights and data.

Start generating and capitalizing on insights using AI. Learn more about how Market Logic can help you become an insights-driven enterprise. Contact us or email info@marketlogicsoftware.com to book a free consultation with a member of our team.