Large organizations don’t make the most of their market insights and data assets. Badly integrated data and platforms are to blame.

A recent Market Logic and Insight Platforms survey of product and marketing leaders in large companies highlights both the importance of market insights for decision-making – and the barriers to their effective use.

Nine out of ten managers in product / innovation and marketing / brand teams are totally or very heavily reliant on consumer market insight.

And yet, 33% of marketing / brand decisions and 45% of product / innovation decisions fail to makeuse of this data.

Why does this gap exist — and how can this gap be closed?

Technology systems are one of the leading culprits.

Fragmented data, systems and formats are the greatest barriers to using data and insights.

The barriers to using market insights

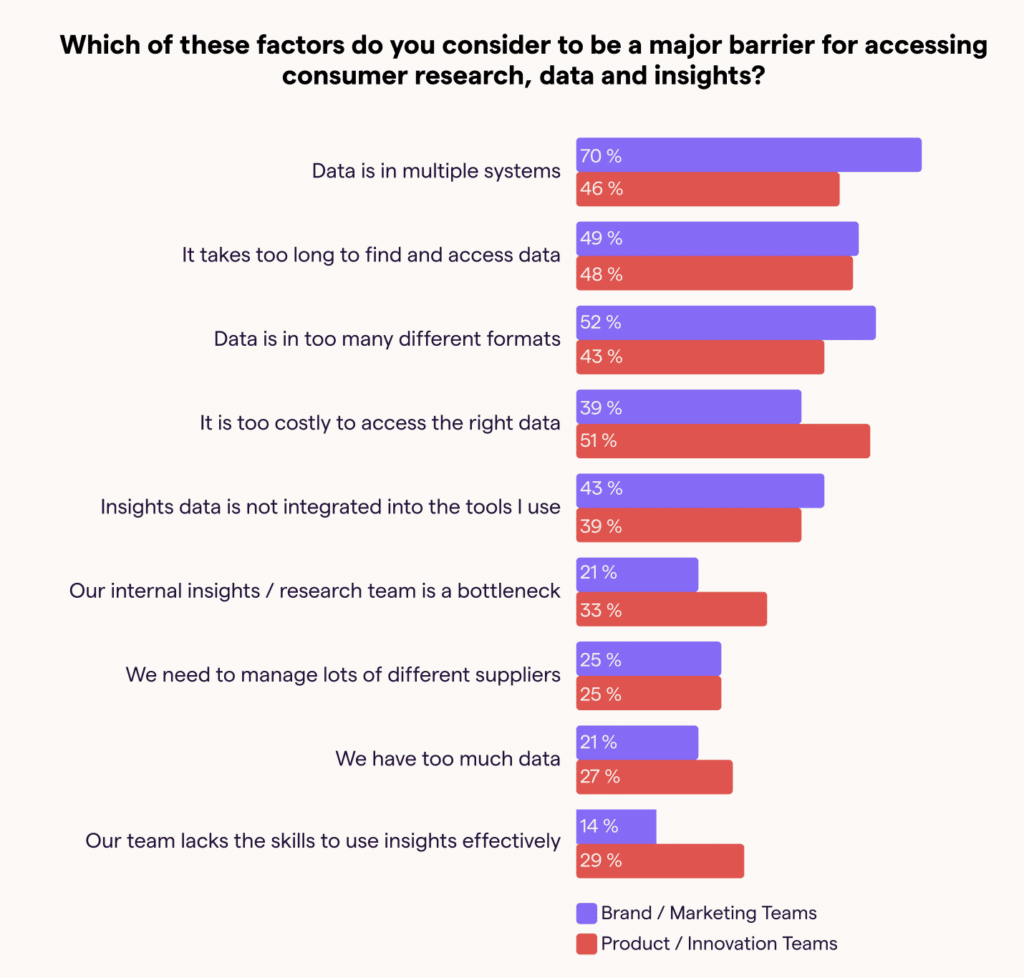

The survey data tell a clear story: Technology and process barriers have by far the biggest impact on wider adoption of market insights for decision-making:

The principal barriers to greater use of market insights & data all relate to technology: the separation of data in multiple systems (54%), data residing in too many formats (48%) and a lack of integration of insights into the tools used by marketing and product teams (41%).

These barriers have knock-on implications for efficiency and budget: 49% of respondents say that it takes too long to find and access data, and 45% say that it is too costly to access the right data.

There are some noteworthy differences between marketing / brand and product / innovation teams:

In marketing and brand teams, the challenge of fragmented data — in too many systems (60%) and formats (52%) — is much more pronounced.

This may reflect the phenomenon of ‘stack overload’ in marketing teams, where the average large enterprise has nearly 100 different cloud marketing tools. The volume of applications and lack of integrated data appear to be significant limiters on the use of consumer insights for decision-making in marketing teams.

For product and innovation teams, the picture is slightly different. The main barriers are the costs of accessing data and the time it takes to find it — closely followed by poor data and systems integration.

To address these barriers, the most frequently identified solutions are technology-based: an integrated and centralized platform for data & insights (38%) and improved analytics / data visualization tools (31%).

What changes would help you to use consumer research, data and insights in more of your work?

An easy-to-use platform with all data at my fingertips; the ability to type in a question and have it provide the answer rather than me having to analyze the data myself.”

Large Enterprise, Consumer Goods, Marketing / Brand, USA / Canada

More integration with AI and daily used software; make more decisions faster and more efficient, saving time dedicating routine tasks to AI.”

Mid-Sized Corporate, Consumer Goods, Marketing / Brand, Europe / UK

More integrated systems and ease of accessing information; Would like to have consumer panel data integrated with market data for our own brands and items as well as that of the competition.”

Mid-Sized Corporate, Consumer Goods, Product / Innovation, USA / Canada

When all teams have access to the same data, it confirms that consistency and allows for more comprehensive analysis. That is why improving data integration across different departments is difficult. Usually, a centralized data management system would be a significant improvement. This would ensure that all departments have access to the same up-to-date information that ..{helps in}…, reducing discrepancies and improving collaboration.”

Large Enterprise, Consumer Goods, Product / Innovation, USA / Canada

The power of integrated insights platforms

Market insights and data are captured, analyzed and reported in an ever-growing array of software tools. There are more than 1,500 research and insights applications and a further 11,000 marketing technology SaaS products, many of which provide user or consumer data and analytics.

Integrated insights or knowledge management (KM) platforms help to unify disparate sources of data, democratize access to consumer knowledge and empower product and marketing teams to use consumer insights quickly and easily in their day-to-day activities.

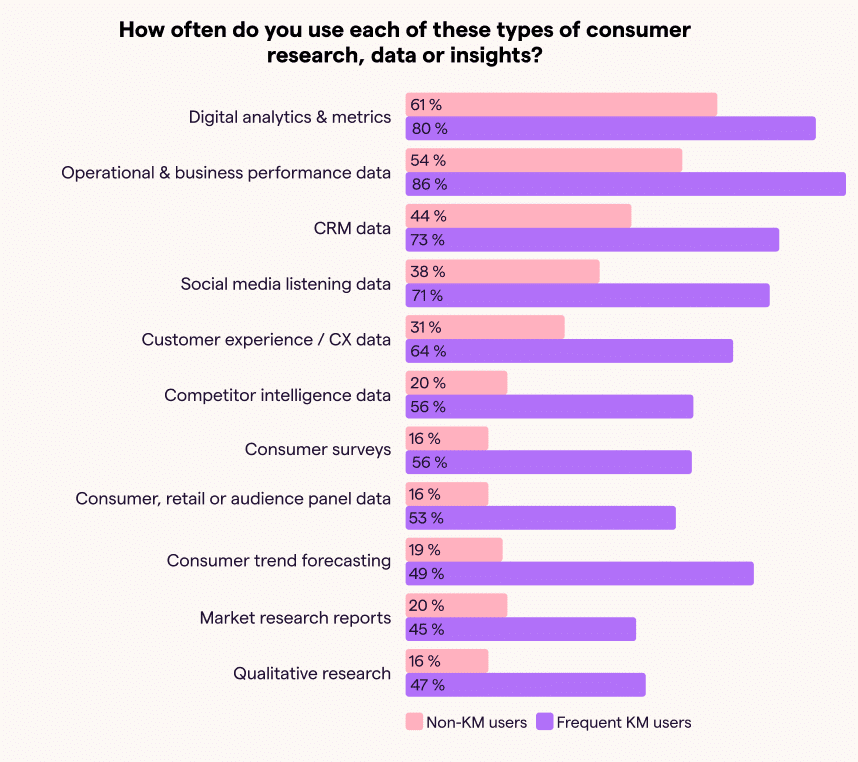

The data in our survey demonstrates how impactful these tools can be. Those who use knowledge management platforms for consumer insights consistently demonstrate more frequent and more effective use of insights.

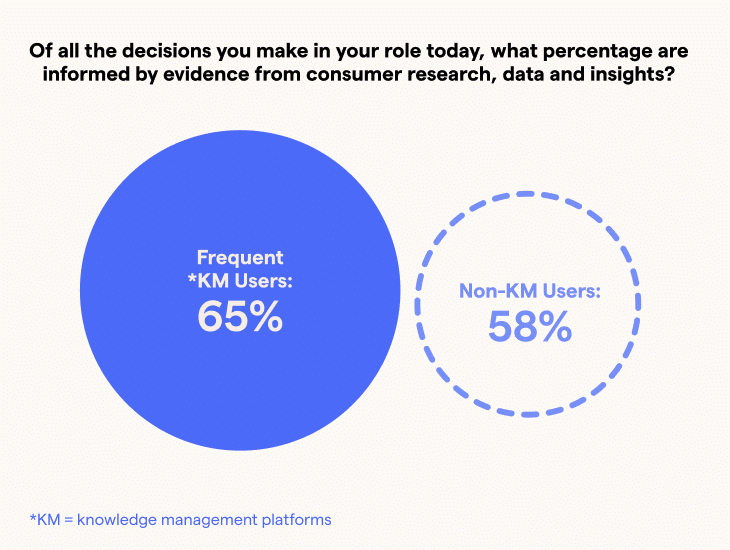

Regular KM platform users inform a greater share of their decisions with insights:

Frequent KM users benefit from more regular access to all types of consumer data and insights:

Frequent KM users are also much less likely to identify slow access to data as a major barrier:

Closing the data and market insights gap

Putting insights into product and marketing teams’ workflows and applications strongly correlates with more frequent use of insights: those who use knowledge management (KM) platforms regularly (47%) base a higher share of their decisions on insights (65%) than those who do not.

Consumer / market insight (CMI) leaders should focus on deploying systems that centralize access to insights and connect outputs directly into the tools already used by marketing and product teams; they should also ensure that their support for product teams is as impactful as it is for marketing teams.

Read our recently published report, created with Insight Platforms, on hyperscaling insights for the full survey results — and learn how your organization can power up more decisions with insights and data.

Start generating and capitalizing on insights using AI. Learn more about how Market Logic can help you become an insights-driven enterprise. Contact us or email info@marketlogicsoftware.com to book a free consultation with a member of our team.